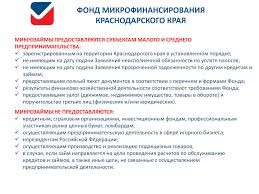

Fund of microfinance of Krasnodar Krai In Krasnodar Krai within implementation of the long-term target program for support of small and average business the Fund of microfinance of Krasnodar Krai is created

A founder of Fund is the administration of Krasnodar

Krai represented by Department of investments and development of small and

average business of Krasnodar Krai.

A founder of Fund is the administration of Krasnodar

Krai represented by Department of investments and development of small and

average business of Krasnodar Krai.

The microloans provided by Fund give the chance to small business in the

operational mode to raise money on an attractive interest rate from 3,5% to 10%

per annum in the sum up to 3 000 000 rubles for up to 3 years. Besides, in the

loan agreement there are no hidden payments, the commissions and an insurance.

In May, 2017 changes have been made to rules and conditions of granting

microloans by Fund of microfinance that has allowed the subjects conducting

trade activity and activities for leasing of the real estate to use state

support also.

Changes have concerned also the operating products of Fund:

1) "Start" Ц is provided to the beginning businessmen whose term of

activity from 3 to 12 months, for replenishment reverse and acquisitions of

fixed assets and also constructions, capital repairs or reconstruction of the

non-residential premises used for business activity. The sum of a microloan is

from 100 thousand rubles up to 700 thousand rubles, an interest rate of 7% per

annum, the term of granting is from 7 to 24 months.

Establishment of a grace period of repayment of a principal debt up to 6 months

is possible.

2) "Farmer" Ц is provided for carrying out seasonal and field works.

The microloan sum from 100 thousand rubles to 3 million rubles, an interest

rate of 8,75% per annum, term of granting it is prolonged from 3 months to 24

months. At the request of the farmers of Kuban addressing to Fund, the grace

period on return of the main sum of a microloan up to 9 months is prolonged.

3) On the product "Business Turn" provided on replenishment of

current assets under 10% per annum microloan term up to 24 months is also

prolonged.

4) "Business and Investment" Ц is provided for acquisition of fixed

assets and also construction, capital repairs or reconstruction of the

non-residential premises used for business activity. The sum of a microloan is

from 100 thousand rubles to 3 million rubles, an interest rate of 10% per

annum, term of granting from 3 to 36 months.

5) For acquisition, a construction, production of fixed assets and also

replenishment of current assets the microloan "Handicraftsman" under

6,25% per annum for a period of up to 24 months with a possibility of receiving

a grace period on return of the main sum of a microloan up to 6 months is

provided to the businessmen who are carrying out craft activity.

6) Novotekh Ц is provided for acquisition of new fixed assets under their

pledge. The product is specially developed for the businessmen having

difficulties with providing pledge, but needing fixed assets. The sum of a

microloan is from 100 thousand rubles to 3 million rubles, an interest rate of

9% per annum, granting term Ц from 1 to 36 month